There has been a lot of discussion and buzz surrounding the new CARES Act that will be going out to support colleges and universities. As enrollment managers and student success folks, we are facing an extremely challenging time. But what we may forget in the stress and chaos is that there is an opportunity to get ahead and best support both prospective and current students in a way that we never have before. In this article, we’ll walk through what the CARES Act is and how we can use this as an opportunity on your campus.

The What of the CARES Act

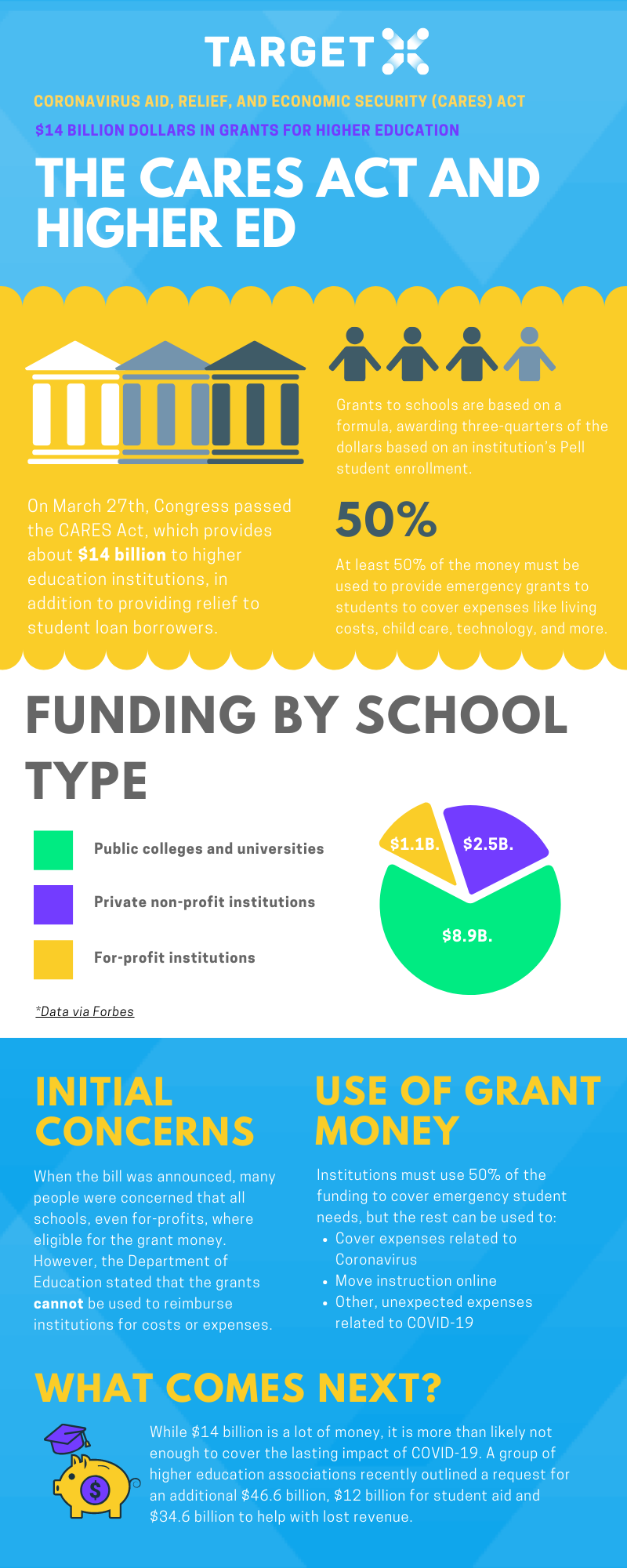

In late March, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) to help combat the debilitating impact of COVID-19 across the nation. Part of the CARES Act includes funding for education, and $30.5 billion has been set aside for a range of purposes. It breaks down to $3 billion for The Governor’s Emergency Education Relief, $13.5 billion for K-12 education, and $14 billion in grants for higher education. Separate allotments have been set aside for Native schools, and an additional $354 million for smaller schools being hit particularly hard during this time.

The funds will be distributed through the Title IV distribution system, and will be distributed according to a formula, which is still being worked out. However, we do know that it will be based on the percentage of full time Pell Grant recipients at an institution (75% of the calculation), with the other 25% of the calculation going toward the non Pell Grant recipients. Excluded from the equation are students who were completing their education completely online before the Coronavirus outbreak.

While the complete formula is still in the works, a full list of allocations has been shared by the government. A study done by Ben Miller, vice president of postsecondary education at the Center for American Progress, did an analysis of the funding, and found that about $8.9 billion will go to public colleges and universities, $2.5 billion will go to private nonprofit institutions, and $1.1 billion will go to for-profit schools. Many were worried about the funds being made available to for-profit schools, and the Department of Education has not yet addressed those concerns.

How to Apply

To apply for CARES Act funding, a school just has to fill out the Certificate of Funding and Agreement. However, there are stipulations for what the money can be used for. 50% of the money granted to an institution must be given to students to combat the impact of coronavirus, and can be put toward anything from housing costs, food, course materials, child care, and technology. The remaining 50% of the funds can be used to combat the unforeseen circumstances introduced by Coronavirus, and can be used to help aid in the switch to online learning. It is important to note that the funds cannot be used to reimburse institutions for costs and expenses. For example, this means that a college or university cannot put the grant money towards refunding students for housing. The money also cannot be used for any pre-enrollment recruitment activities.

Distribution of Funds on Campus

Once an institution has received the grant money, it is up to them to distribute the funds to students as needed. The Secretary of Education released a statement encouraging schools to think of the neediest students first, and establish a threshold per student, so that as many students as possible benefit from the funds. A formal, written policy may also be helpful to ensure that the students who need the money most have access to it.

Staff and Faculty Support

Because the funds from the CARES Act cannot be used to pay employees or cover expenses, they are getting protection in another way. The CARES Act modified two key types of SBA loans so that more people and business types can apply for them. One of these programs is the Paycheck Protection Program, which gives loans to businesses with 500 employees or fewer, and cannot be given to government institutions. The application period for this type of loan runs from April 3 to June 30. Additionally, Economic Disaster Injury Loans (EIDL) now have expanded eligibility, and have waived certain application requirements. EIDL provides working capital to small businesses and nonprofits when they are unable to meet necessary financial obligations due to a disaster. Like the Paycheck Protection Program, these loans are not available to government institutions.

Looking Ahead

As things continue to unfold throughout the Coronavirus pandemic, additional funding is likely going to be needed. A report by Forbes explains that while $14 billion is a lot of money, it is not nearly enough to recuperate the higher education landscape following such a drastic downturn. Some higher education associations have already requested additional funding. This would include $12 in student aid, and $34.6 billion to help recoup lost revenue.

What Does This Mean

We are at a crossroads in higher education. Not just responding, but responding well is critical to institutions surviving and thriving through these unusual and trying times and quite honestly will make or break institutions. One thing we keep hearing is thinking about mission critical – the current students in the spring semester/trimester and to yield enough students to fill the 2020 class. These are absolutely essential pieces to the puzzle and being thoughtful and student centric will separate out the truly exceptional colleges.

The CARES Act offers colleges and universities a very small financial cushion to serve students during this difficult time. As your university builds out it’s plan on how to allocate CARES Act resources, you should consider what resources and technology are in place as you enter into the recruiting and student success cycle of 20/21 and ensure that you’re focused on building out the best future classes that you can. The funding may not impact your enrollment efforts directly, but can help offset other costs from COVID-19 that will allow you to continue to prioritize your enrollment investments. The ability to be innovative and to have the right tools for your team are critical to your success.

As your institution finalizes it’s plans on how to use the CARES Act, first think about how to best serve your students now, and then think about how you can serve your future students. Make sure that a holistic approach is being used in your evaluation. Setting up success for the immediate, but also future enrollment will be the key to success in these trying times.